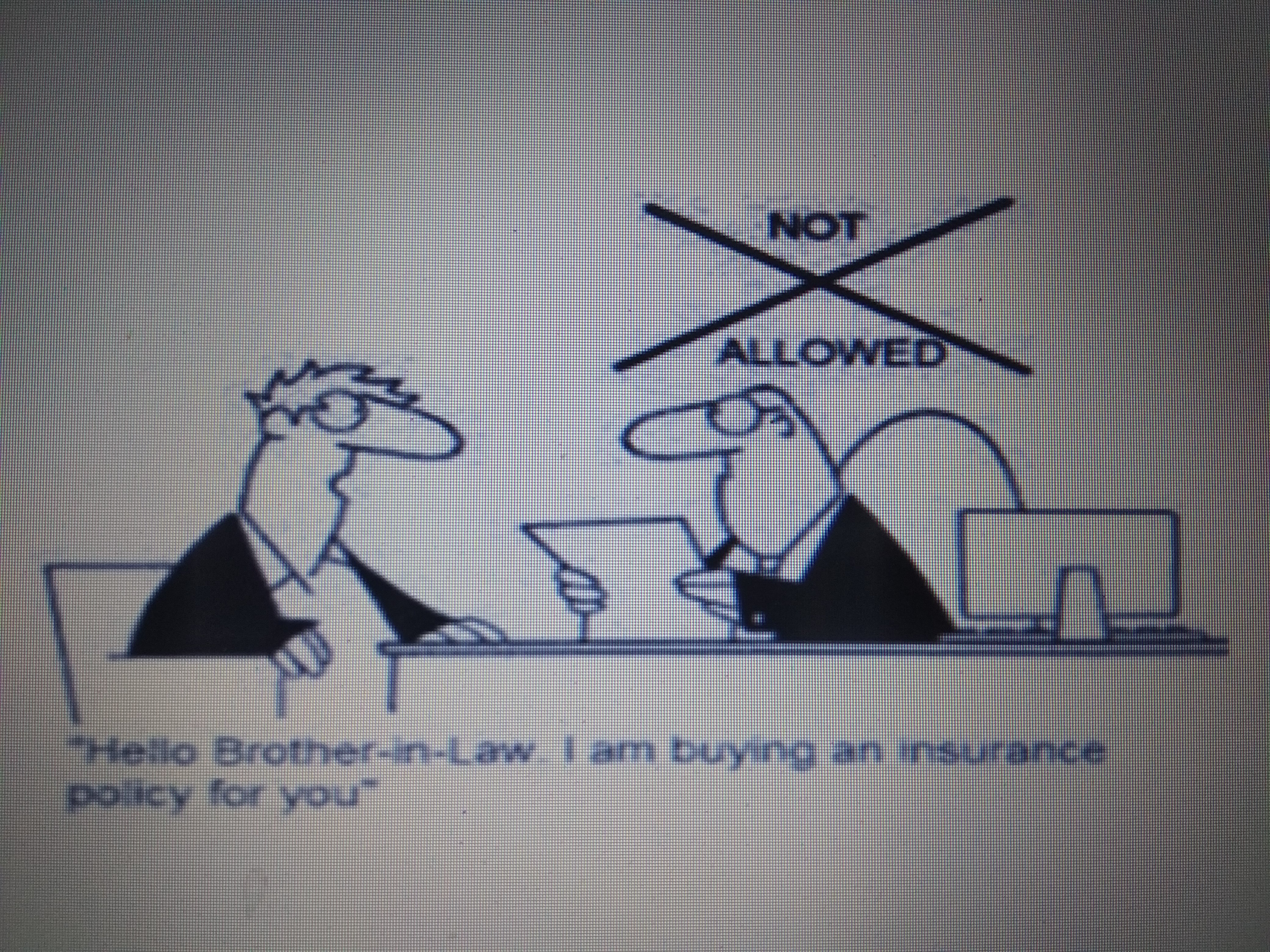

However, the question arise whether we can buy Life Insurance for blood relations only. The answer is No ! we can buy life insurance on someone else also. But, only if we have insurable interest in them and also their consent.

Here Insurable interest means that we would be adversely affected financially, if the person who is insured, dies. In other words, we cannot purchase life insurance on the stranger we met at the grocery store yesterday. That person has no bearing on our finances. If that person died, we would not be affected financially.

The reasoning behind requiring insurable interest is so that the death of the insured person does not create personal gain for the policyholder. Allowing someone to be able to own life insurance on just about anyone could possibly lead to intentional harm.

Some of the Non-blood relations in which Insurable interest exists are :

1) Employer - Employee

2) Business Partners

3) Creditor - Debtor

4) Company - Key Man Employee

Comments

Add Comment