Narendra's BLOGS

NET PROMOTER SCORE (NPS) for CORPORATES

Published: Dec 19th, 2020 09:44 am By Narendra TiwariOf course. Everybody does that. In fact, they post about this on social media, so that all their friends know about it.

Latest data suggests that nearly 90% people read online reviews before visiting a business, 80% referrals come from word of mouth spread by loyalists and 84% trust online reviews as much as a personal recommendation. This is the Power of Word of Mouth Recommendations.

When consumers have a great experience with your company, they will start becoming loyal to your brand. This means they will be more likely to repeat purchasing. In fact, in present market scenario, it is extremely important that we have more and more consumers who are loyal to us and grow our business.

Now-a-days, some of the largest organizations in the World and India as well as Startups are using NPS.to better understand consumer feedback and loyalty.

This Metrics helps us to guage how satisfied our customers are with our products and services and their loyalty towards us. It is arrived at by asking consumers a simple yet powerful question.

NPS Question : “How likely are you to recommend XYZ company to your friends, family or colleagues on a scale of 0 to 10 ?”

Here, Score 9-10 are Promoters

Score 7-8 are Passives – They are somewhat satisfied with us but could easily switch to another brand . So, It’s a sensitive group of people. We need to go forward and delight these customers.

Score 0-6 Detractors – They are unhappy with the brand and may not purchase again. They can speak negatively about company to others too. So, it is very important to address their issues quickly and gain their trust again.

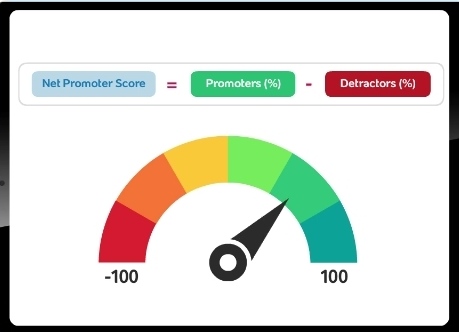

Thus, Net Promoter Score = Promoters(%) – Detractors(%). It’s value ranges from -100 to +100.

For Example : Company A has been working very hard to provide the best product and services to their consumers and have more delighted consumers. It has 55% Promoters, 35% Passives and 10% Detractors, then its NPS is 55-10=45. Whereas,

Company B lacks consumer service with more consumer complaints and issues. They have only 20 % Promoters, 30% Passives and 50% Detractors, its NPS will 20-50=-30.

Besides the NPS question, one should also ask consumers reasons for their score. Due to which, we shall have more details so that we can learn from it and avoid it in the future. Solving their issues will help us to improve the experience for all consumers and drive business growth.

Higher NPS means Higher Persistency, Cross-sell Opportunities and New business through referrals.

By Proactive Feedback, Insight management and Issue Resolution, Customers will have good experience that the company hear them and works on concerns.

Thus, interact and provide the consumers with your product and services, put in effort to delight consumers and start receiving positive responses. It will further motivate them to perform better. If your customers are happy with your products and end to end services, they will rate 9 or 10 on NPS Scale. That means, more people talking good about you and it would result in more customer referrals and business. Customers will stay long over with you and will buy more from you. Hence, always look to delight your consumer.

To Delight your consumers, your representative should have thorough knowledge of products or services represented, he/ she should create a rapport with consumer and be available as-n-when needed for queries or complaints. Also, should value their feedback and appreciate their opinion. The issue if any, should be resolved quickly and informed back to them. If there are repetitive complaints on a specific issue, work to bridge the gap permanently to avoid similar issues in future.

So, have you adopted NPS ?

Equity Stock Market in 2020 January 1st, 2021 10:50 am

Bank Bad Debts.& Role of Collection/ Recovery Agencies December 31st, 2020 11:35 am

Equity Stock Market in 2020 January 1st, 2021 10:50 am

Bank Bad Debts.& Role of Collection/ Recovery Agencies December 31st, 2020 11:35 am

Micro Finance – Need of an Hour December 24th, 2020 11:24 am

HOW TO ACCERLERATE YOUR INSURANCE BUSINESS WITHOUT GOING OUT OF YOUR HOME November 26th, 2020 12:08 pm

Can we Buy Life Insurance for blood relations only ? November 20th, 2020 11:25 am

Comments

Add Comment