lazarus's BLOGS

Per capita premiums and % GDP analysis

Published: Jun 20th, 2023 07:10 pmWelcome, insurance managers, to the fascinating world of per capita premiums and % GDP analysis! Prepare for a data-driven adventure that unveils insights about the insurance industry across countries. Let's dive in!

Per capita, premiums represent the average premium paid for life insurance policies in a country. It's calculated by dividing the total premiums paid in a year by the country's population. And the numbers we have are truly intriguing!

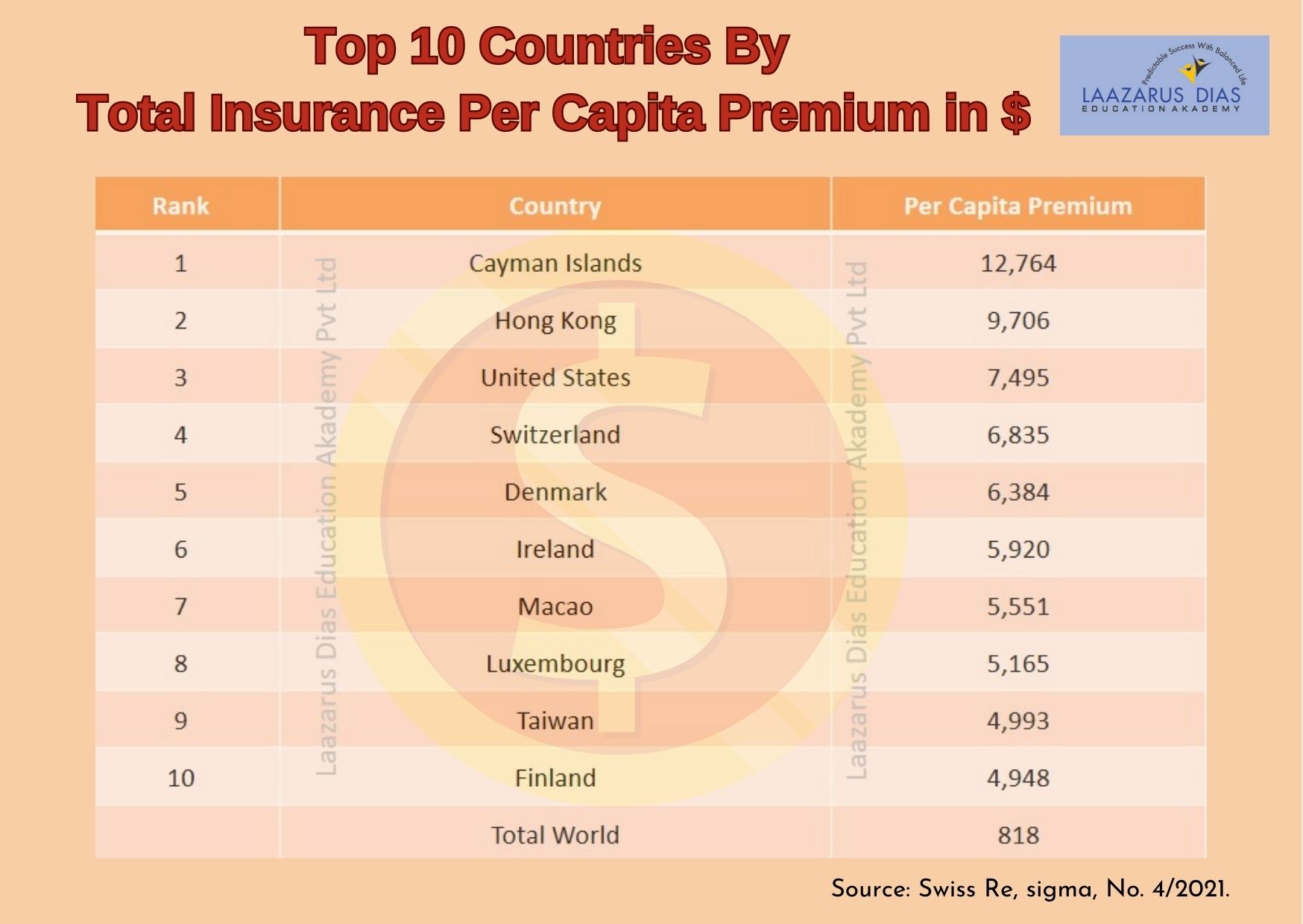

The Top 5 countries with sky-high per capita premiums are the Cayman Islands ($12,764), Hong Kong ($9,706), the US ($7,495), Switzerland ($6,835), and Denmark ($6,384). The global average per capita premium is $818. Talk about serious insurance investments!

So, why does the Cayman Islands have the world's highest per capita premium? Let's uncover the secrets:

1. Tax advantages: The Cayman Islands offers tax benefits, including no income, capital gains, or estate taxes. It's a financial haven indeed!

2. Wealth management: With offshore wealth management at its core, high-net-worth individuals use life insurance as part of their estate planning strategy. This ensures asset protection and smooth transfer to heirs.

3. Favorable regulations: The Cayman Islands boasts a regulatory environment that attracts local and international players to its insurance industry.

4. Diversified economy: The Cayman Islands' strong focus on financial services contributes to a robust insurance sector.

Per capita premiums hold significant meaning. They reflect the level of financial protection individuals and families have against the loss of a breadwinner. A higher percentage indicates effective family management, boosting the country's economy. It also reflects disposable income and economic development. Comparing per capita premiums among countries helps identify marketing strategies, cultural perceptions of life insurance, and growth opportunities.

Now, let's explore another essential metric: the premium as a % of GDP. This sheds light on insurance awareness and country-specific issues. Brace yourself for some eye-opening statistics!

The Top 5 countries with the highest % of premium to GDP are Taiwan (19.97%), Hong Kong (19.74%), the Cayman Islands (19.18%), South Africa (13.40%), and the US (11.43%). Remarkably, the Cayman Islands, US, and Hong Kong appear in the Top 5 for both % GDP and per capita premiums. These exceptional performers excel in the insurance industry.

The premium as a % of GDP reveals the following insights:

1. Financial protection: A higher percentage indicates stronger financial protection, contributing to economic stability.

2. Economic development: It reflects a more economically developed country where people have greater disposable income for insurance.

Both % GDP and per capita premiums provide invaluable insights into a country's insurance industry. They guide companies in tailoring products to meet local needs and identifying growth opportunities.

Comments

Add Comment