lazarus's BLOGS

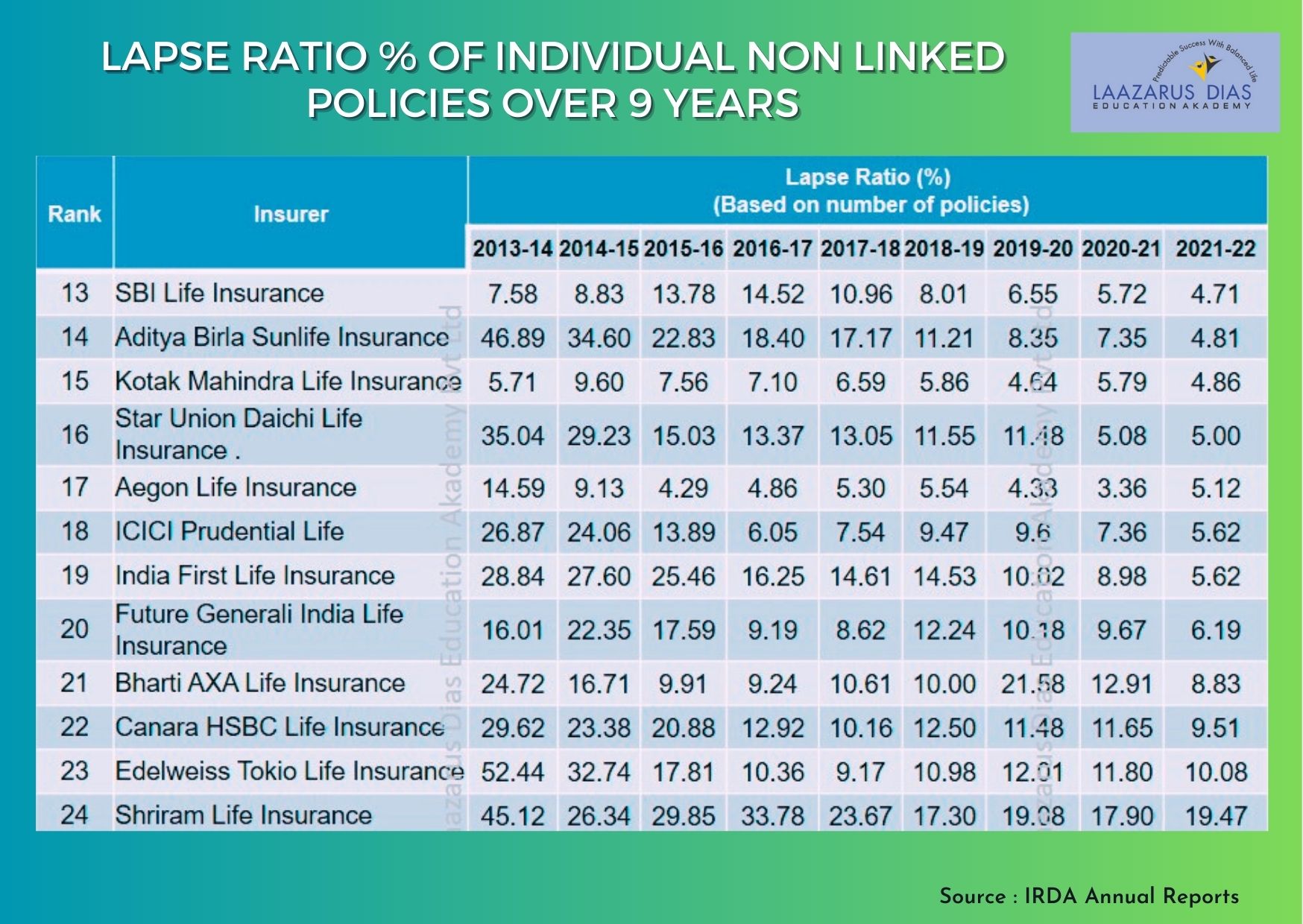

Lapse Ratio % of Individual Non Linked Policies over last 9 Years

Published: Aug 3rd, 2023 05:27 pmThe lapse ratio refers to the percentage of insurance policies that are terminated or canceled by policyholders before the end of their policy term.

The lapse ratio is calculated by dividing the number of policies that lapsed during a specific period by the total number of active policies at the beginning of that period. The result is typically expressed as a percentage.

A high lapse ratio indicates that a significant number of policyholders are discontinuing their policies prematurely, which can impact the profitability and stability of an insurance company.

A low lapse ratio suggests better policyholder retention and can be seen as favorable for the company's financial performance.

Persistency on the other hand tracks the number of started policies that lapse over 1 year, 3 Years, and 5 years and is more interested in how many policies issued complete 1 Year, 3 Yrs or 5 Yrs

Comments

Add Comment