lazarus's BLOGS

Unveiling the Financial Dance: GVA and Domestic Saving in India (2021-22)

Published: Jun 20th, 2023 06:36 pmLet's embark on a journey to unravel the fascinating

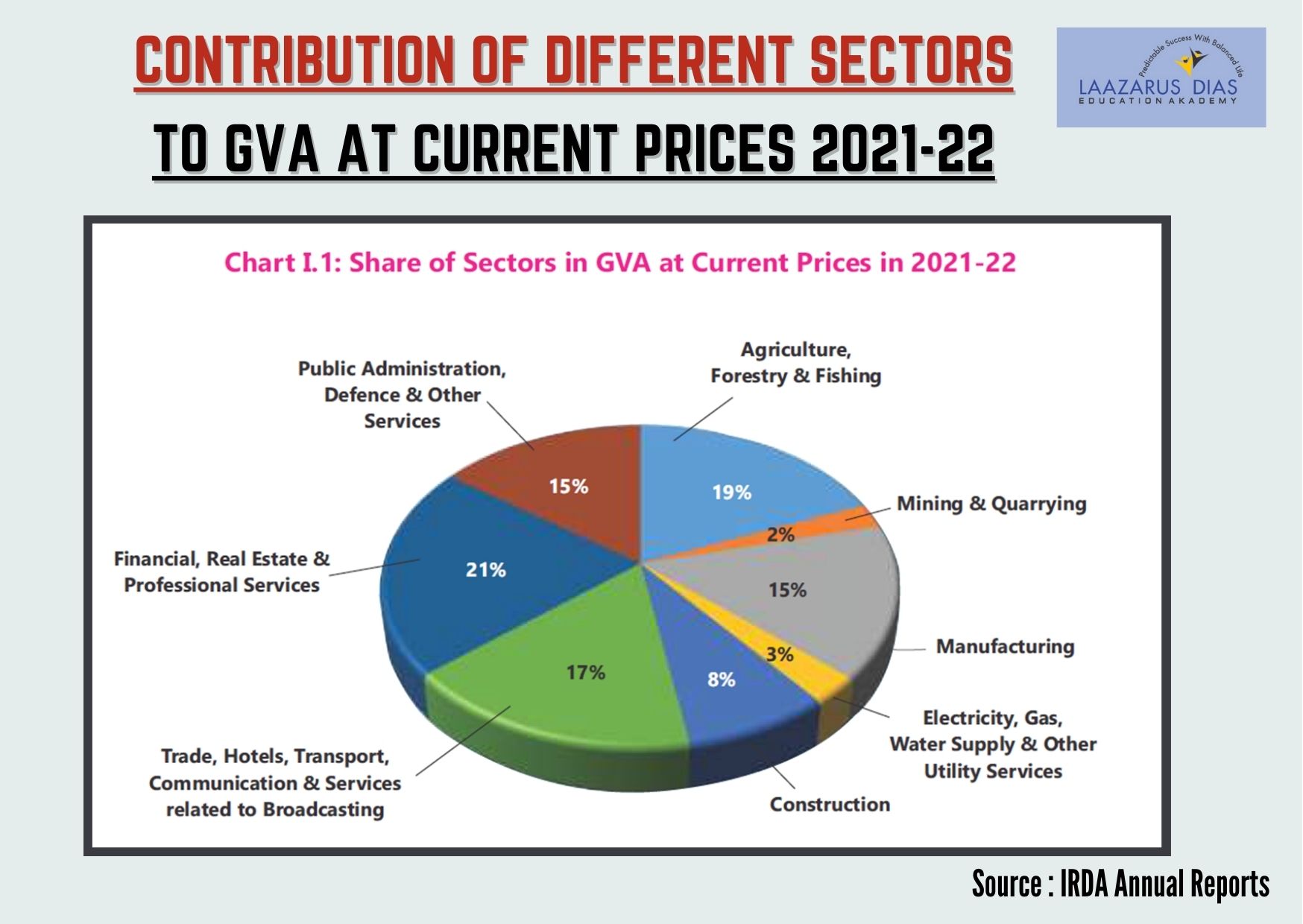

world of GVA and domestic saving in India. GVA, short for Gross Value Added, is

a nifty metric that measures the economic value generated by specific sectors,

industries, or regions. It's calculated by subtracting the cost of inputs from

the total value of outputs produced within a given period. Think of it as a

thermometer that assesses the health and performance of an economy. It helps

policymakers and analysts understand the contribution of different sectors to

the overall GDP (Gross Domestic Product), identifying areas of strength and

weakness along the way. You see, government policies have a direct impact on

the GVA of a sector. For instance, an investment-friendly policy can boost the

GVA of a particular sector, while increased taxes may put a dent in GVA for

certain businesses.

Now, let's meet another player in this financial

ballet: Gross National Disposable Income (GNDI). This macroeconomic measure

captures the total income received by residents of a country from various

sources like wages, salaries, profits, and other income types. GNDI reflects

the economic well-being of a nation's citizens. How is it calculated; you ask?

It's the Gross National Income (GNI) minus taxes plus subsidies. It's like a

financial rollercoaster, considering all the taxes and government fees paid and

the subsidies received.

So, what does the latest performance reveal? Buckle

up!

The household sector is flexing its financial muscles,

saving a whopping 21.9%. That's an improvement of 1.7% from the previous year.

Financial corporations, on the other hand, are saving approximately 3%, while

non-financial corporations are stashing away around 10%. These savings have

largely remained unchanged, proving that some things in the financial realm are

as steady as a rock.

But wait, there's more! Brace yourself for a

surprising twist. The general government has borrowed more than double the

amount from last year, clocking in at 6.7% compared to a mere 3.1%. That's

quite the financial leap!

Now, let's pause for a moment and reflect on the

significance of these numbers for the insurance industry. Understanding GVA and

GNDI can be a game-changer, shedding light on the financial well-being of

individuals and businesses. A thriving economy with increasing GVA and GNDI

indicates potential opportunities for the insurance industry. When people and

businesses have higher disposable income, they may be more inclined to invest

in insurance products.

These figures act as a compass for the insurance industry,

guiding market analysis and target segment identification. GVA and GNDI provide

insights into the purchasing power of consumers, enabling insurers to tailor

their product offerings and pricing strategies accordingly. By understanding

the disposable income levels of individuals and households, agents can gauge

the affordability and demand for different policies, helping them craft

effective sales strategies.

Let's embark on a journey to unravel the fascinatingworld of GVA and domestic saving in India. GVA, short for Gross Value Added, isa nifty metric that measures the economic value generated by specific sectors,industries, or regions. It's calculated by subtracting the cost of inputs fromthe total value of outputs produced within a given period. Think of it as athermometer that assesses the health and performance of an economy. It helpspolicymakers and analysts understand the contribution of different sectors tothe overall GDP (Gross Domestic Product), identifying areas of strength andweakness along the way. You see, government policies have a direct impact onthe GVA of a sector. For instance, an investment-friendly policy can boost theGVA of a particular sector, while increased taxes may put a dent in GVA forcertain businesses.

Now, let's meet another player in this financialballet: Gross National Disposable Income (GNDI). This macroeconomic measurecaptures the total income received by residents of a country from varioussources like wages, salaries, profits, and other income types. GNDI reflectsthe economic well-being of a nation's citizens. How is it calculated, you ask?It's the Gross National Income (GNI) minus taxes plus subsidies. It's like afinancial rollercoaster, considering all the taxes and government fees paid andthe subsidies received.

So, what does the latest performance reveal? Buckleup!

The household sector is flexing its financial muscles,saving a whopping 21.9%. That's an improvement of 1.7% from the previous year.Financial corporations, on the other hand, are saving approximately 3%, whilenon-financial corporations are stashing away around 10%. These savings havelargely remained unchanged, proving that some things in the financial realm areas steady as a rock.

But wait, there's more! Brace yourself for asurprising twist. The general government has borrowed more than double theamount from last year, clocking in at 6.7% compared to a mere 3.1%. That'squite the financial leap!

Now, let's pause for a moment and reflect on thesignificance of these numbers for the insurance industry. Understanding GVA andGNDI can be a game-changer, shedding light on the financial well-being ofindividuals and businesses. A thriving economy with increasing GVA and GNDIindicates potential opportunities for the insurance industry. When people andbusinesses have higher disposable income, they may be more inclined to investin insurance products.

These figures act as a compass for the insurance industry,guiding market analysis and target segment identification. GVA and GNDI provideinsights into the purchasing power of consumers, enabling insurers to tailortheir product offerings and pricing strategies accordingly. By understandingthe disposable income levels of individuals and households, agents can gaugethe affordability and demand for different policies, helping them crafteffective sales strategies.

So, dear insurance industry managers, embrace thepower of GVA and GNDI, and let the dance of financial insights lead you tosuccess. Get ready to captivate the market and offer tailored solutions thatresonate with the evolving financial landscape.

So, dear insurance industry managers, embrace the

power of GVA and GNDI, and let the dance of financial insights lead you to

success. Get ready to captivate the market and offer tailored solutions that

resonate with the evolving financial landscape.

Comments

Add Comment