lazarus's BLOGS

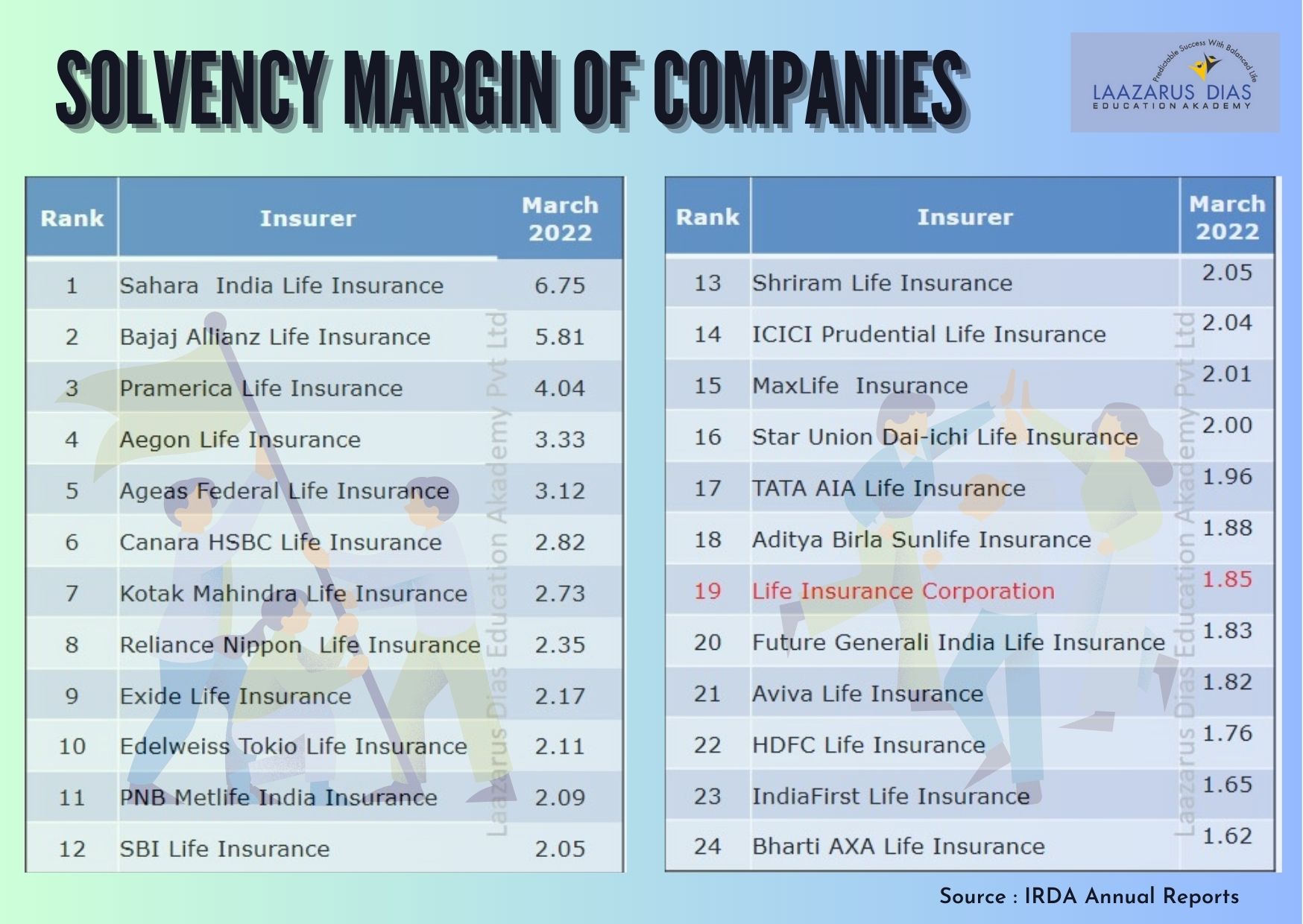

Solvency Margin of Life insurance Companies in India

Published: Aug 3rd, 2023 04:33 pm The

solvency margin of an insurance company refers to the excess of its assets over

its liabilities

It

is an important indicator of the financial strength and ability of the company

to meet its obligations.

The

minimum mandated is 1.5

A

high solvency margin indicates that an insurance company has a strong financial

position and is able to withstand adverse market conditions, unforeseen events,

and catastrophic losses.

LIC

of India has a solvency margin of 1.85 but is 19th in the list.

Solvency

Margins can be increased by the following methods

• Thesolvency margin of an insurance company refers to the excess of its assets overits liabilities

• Itis an important indicator of the financial strength and ability of the companyto meet its obligations.

• Theminimum mandated is 1.5

• Ahigh solvency margin indicates that an insurance company has a strong financialposition and is able to withstand adverse market conditions, unforeseen events,and catastrophic losses.

• LICof India has a solvency margin of 1.85 but is 19th in the list.

SolvencyMargins can be increased by the following methods

Comments

Add Comment