lazarus's BLOGS

The Thrilling World of Premium Volumes: Top 10 Countries (2019-20)

Published: Jun 20th, 2023 06:52 pmWelcome to the realm of premium volumes, where the

global stage is set for fierce competition among countries. Get ready to

witness the powerhouses that dominate the insurance industry. Hold on to your

seats as we unveil the top 10 countries by total premium volumes written!

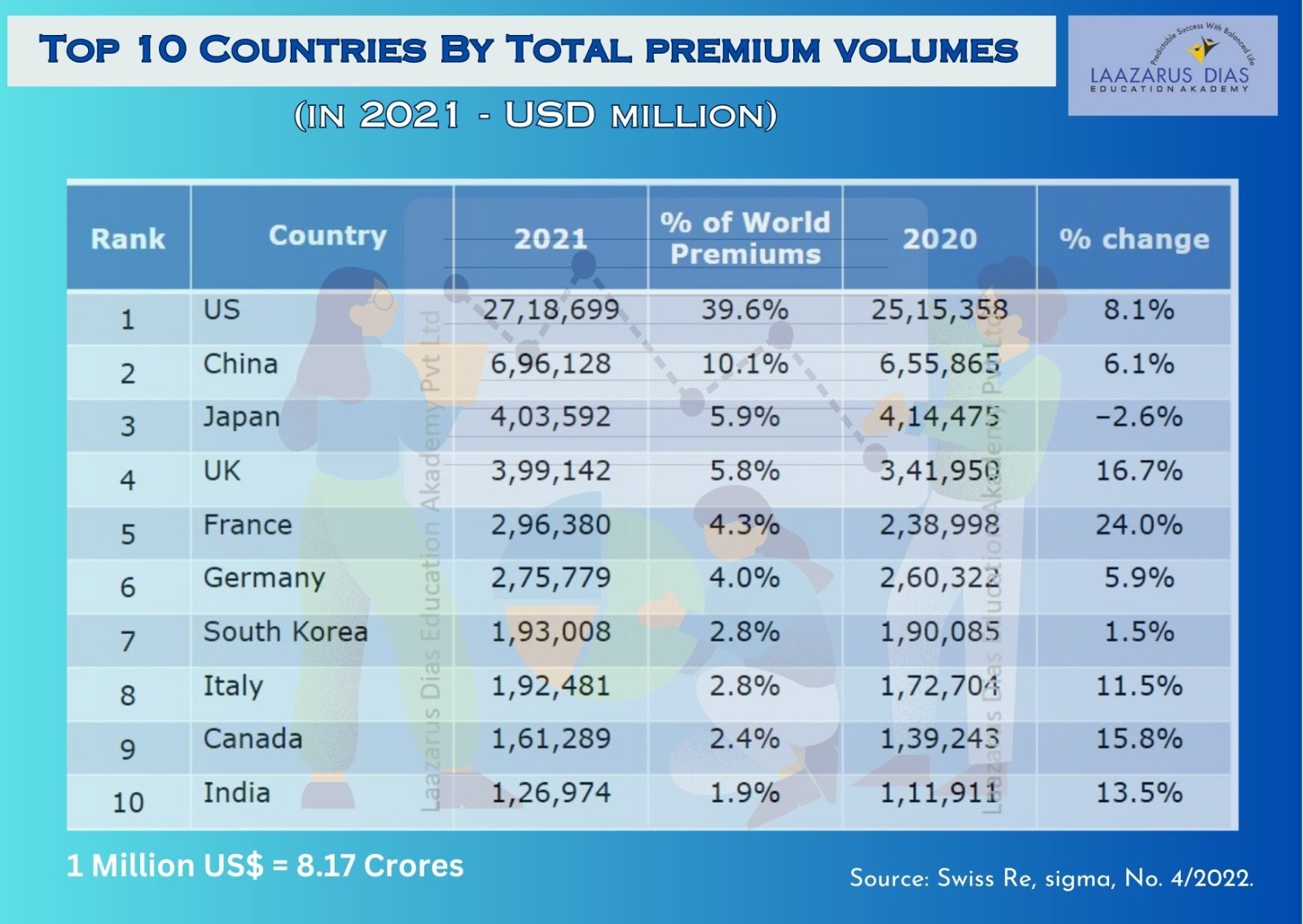

Leading the pack is none other than the USA, basking

in its glory with a premium of a staggering 27.18 Lakh $ Million. The USA

reigns supreme, accounting for a jaw-dropping 39.6% contribution to the world's

total premiums. Talk about making it rain in the insurance world!

But wait, the USA isn't the only star of the show. The

top 10 countries collectively command a whopping 80% of the total direct

premiums collected worldwide in 2020-21. Picture this: the number one country

claims 40% of the total premium volumes, while the next 9 countries contribute

another 40%. Meanwhile, all other countries make up the remaining 20%. It's a

high-stakes game with big players in the spotlight.

Now, let's turn our attention to India, strutting its

stuff at the 10th spot. India showcases its prowess with a total premium volume

of 1,26,974 $ Million, contributing a solid 1.9% to the world's premium. A

small but mighty contender in the global insurance arena.

But what about growth? Buckle up for some exciting

revelations. Ireland and Luxembourg take the lead, showcasing an impressive

growth of 31% compared to 2020. South Africa and France are not far behind,

flexing a growth of 24% in their premium volumes. These countries prove that

digitalization was already their secret weapon before the pandemic hit. Their

foresight and preparedness allowed them to navigate the turbulent times and

emerge with fantastic growth. In contrast, other countries experienced a

delayed surge in digitalization, which impacted their growth rates.

Hold your breath as we dive into the top 20 countries.

Hong Kong and Japan experienced a slight decline with a degrowth of 1% and 2.6%

respectively. Taiwan, on the other hand, remained steady, showing no growth

compared to 2020. It's a thrilling rollercoaster of numbers!

One thing remains clear: despite the pandemic's upheaval, nearly 18 countries showcased growth in their premium volumes. This demonstrates the insurance companies' agility in adapting to the unimaginable impact of COVID-19. The pandemic pushed the actuarial and underwriting departments back to the drawing board, challenging them to devise mechanisms to brace for future events and prevent losses. These seismic events have the power to alter risk perception, reshape premium volumes, and redefine coverage availability in specific areas. So, dear insurance managers, take inspiration from these global players and embrace the winds of change. Innovate, digitalize, and envision a future where the insurance industry thrives, no matter what challenges lie ahead. It's time to rewrite the rules of the game and secure a triumphant future for your companies.

Comments

Add Comment